Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

The Ultimate Guide to Effective Money Management - Discover a Better Way To Budget

Managing your finances can often feel overwhelming and stressful. Many people struggle with budgeting and find it difficult to keep track of their expenses, savings, and investments. However, with the right approach and tools, budgeting can become a more manageable and even enjoyable process.

In this comprehensive guide, we will explore a better way to budget that will help you take control of your finances and achieve your financial goals. With practical tips, proven strategies, and useful tools, you'll learn how to budget effectively and make smarter financial decisions.

Why Traditional Budgeting Doesn't Work

Traditional budgeting typically involves creating a rigid plan based on fixed income and expenses. However, life is unpredictable, and unexpected events can quickly derail even the most diligent budget. Moreover, traditional budgeting tends to focus solely on limiting spending rather than fostering a healthy financial mindset.

4 out of 5

| Language | : | English |

| File size | : | 1212 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 232 pages |

| X-Ray for textbooks | : | Enabled |

That's where a better way to budget comes in. By adopting a flexible and holistic approach, you can create a budget that adapts to your ever-changing circumstances while promoting positive financial habits that last a lifetime.

The Benefits of a Better Way to Budget

A better way to budget offers numerous advantages over traditional approaches. Here are just a few key benefits:

1. Financial Awareness:

Understanding your income, expenses, and overall financial picture is crucial to making informed decisions. By using a better way to budget, you'll gain a deep understanding of your finances and be able to identify areas for improvement.

2. Flexibility:

Life is full of unexpected events, and your budget should be able to adapt to them. A better way to budget allows for flexibility, so you can handle unforeseen expenses without feeling overwhelmed.

3. Goal-Oriented:

A better way to budget helps you set and achieve financial goals. Whether you want to save for a down payment on a house, pay off debt, or invest in your retirement, this approach provides a roadmap to reach your objectives.

4. Financial Freedom:

By gaining control over your finances and minimizing unnecessary debt, you'll experience a newfound sense of financial freedom. This can greatly reduce stress and improve your overall well-being.

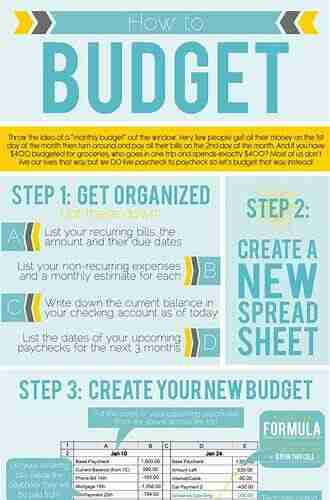

How to Implement a Better Way to Budget

Now that you understand the benefits of a better way to budget, let's dive into the steps you can take to implement this approach:

1. Evaluate Your Current Financial Situation

Begin by assessing your current income, expenses, savings, and debts. This will give you a clear picture of your financial health and enable you to identify areas that need improvement.

2. Set Financial Goals

Define short-term and long-term financial goals that align with your values and aspirations. Whether it's saving for a dream vacation, paying off credit card debt, or building an emergency fund, setting clear goals will give your budget a purpose and help guide your financial decisions.

3. Create a Realistic Budget

A better way to budget involves creating a realistic spending plan that accommodates your income, expenses, and savings goals. Consider using budgeting tools or apps to track your income and expenses effectively.

4. Track Your Progress

Regularly review your budget and track your progress towards your financial goals. This will enable you to make adjustments if necessary and stay motivated along the way.

5. Make Smart Financial Decisions

A better way to budget involves making conscious decisions about where your money goes. Prioritize your expenses, identify areas where you can cut back, and allocate funds towards activities that align with your goals.

6. Seek Professional Advice

If you feel overwhelmed or unsure about managing your finances, don't hesitate to seek advice from a financial advisor or planner. They can provide personalized guidance based on your specific circumstances and help you maximize your financial potential.

By adopting a better way to budget, you'll gain control over your finances, reduce stress, and work towards achieving your financial goals. Remember, budgeting is not about restricting yourself but rather about making conscious choices that align with your priorities and aspirations.

Start implementing these strategies today, and experience the long-lasting benefits of effective money management. Embrace this better way to budget, and watch your financial life transform!

4 out of 5

| Language | : | English |

| File size | : | 1212 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 232 pages |

| X-Ray for textbooks | : | Enabled |

A Better Way to Budget provides practical, innovative advice on how to overcome the political and social pushback that often prevents district and school leaders from shifting scarce resources to the most student-centered uses. Nathan Levenson shows how school leaders can uncover the sources of potential conflicts and create a budgeting process that normalizes change, minimizes pushback, and builds public buy-in for needed reforms.

A Better Way to Budget:

- focuses on a strategic and process-oriented approach that anticipates roadblocks and challenges;

- introduces eight effective strategies for shifting funds and winning support;

- provides real-life examples of mistakes and successes; and

- includes joint fact-finding, simulations, and other exercises to help stakeholders agree on goals and identify the budgetary changes needed to reach those objectives.

Filled with advice gathered over decades of work in schools, A Better Way to Budget provides timely insights and tools for leaders who are exploring ways to make their districts more inclusive and student-centered.

Harrison Blair

Harrison BlairSoldiers League: The Story of Army Rugby League

The Origin and History The Soldiers...

Bob Cooper

Bob CooperFilm Quiz Francesco - Test Your Movie Knowledge!

Are you a true movie buff? Do you...

Hugh Reed

Hugh ReedDriving Consumer Engagement In Social Media

: Social media has...

Richard Simmons

Richard SimmonsAll You Need To Know About The Pacific Ocean Ocean For...

The Pacific Ocean is the largest ocean in...

Carson Blair

Carson BlairUnveiling the Intriguing World of Complex Wave Dynamics...

The study of complex wave...

Connor Mitchell

Connor MitchellUnraveling the Mysterious Journey of "The Nurse And The...

Once upon a time, in a world of endless...

Colt Simmons

Colt SimmonsHow To Change Your Child's Attitude and Behavior in Days

Parenting can be both challenging and...

Reginald Cox

Reginald Cox10 Groundbreaking Contributions Through Science And...

Science and technology have always...

Ernesto Sabato

Ernesto SabatoUnleashing the Power of Hamilton Education Guides Manual...

Are you struggling with understanding...

Virginia Woolf

Virginia WoolfThe Astonishing Tale of Mars: Lord of the Dragon Throne -...

There has always been a remarkable...

Colt Simmons

Colt SimmonsAn Introduction For Scientists And Engineers Second...

Are you a budding scientist or engineer...

Howard Blair

Howard BlairDiscover the Coolest and Trendiest Friendship Bracelets -...

Friendship bracelets have...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Dustin RichardsonThe Kid from Tomkinsville: The Breathtaking Journey of The Brooklyn Dodgers

Dustin RichardsonThe Kid from Tomkinsville: The Breathtaking Journey of The Brooklyn Dodgers

Wesley ReedExploring the World of Submarine Design: Unveiling the Wonders of Cambridge...

Wesley ReedExploring the World of Submarine Design: Unveiling the Wonders of Cambridge... Israel BellFollow ·11.2k

Israel BellFollow ·11.2k David BaldacciFollow ·6k

David BaldacciFollow ·6k Michael CrichtonFollow ·9.6k

Michael CrichtonFollow ·9.6k Justin BellFollow ·11.2k

Justin BellFollow ·11.2k John MiltonFollow ·13.4k

John MiltonFollow ·13.4k Jason HayesFollow ·3k

Jason HayesFollow ·3k Travis FosterFollow ·5.2k

Travis FosterFollow ·5.2k Mario SimmonsFollow ·2.2k

Mario SimmonsFollow ·2.2k