Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Understanding Personal Insolvency Law Regulation And Policy Markets And The Law

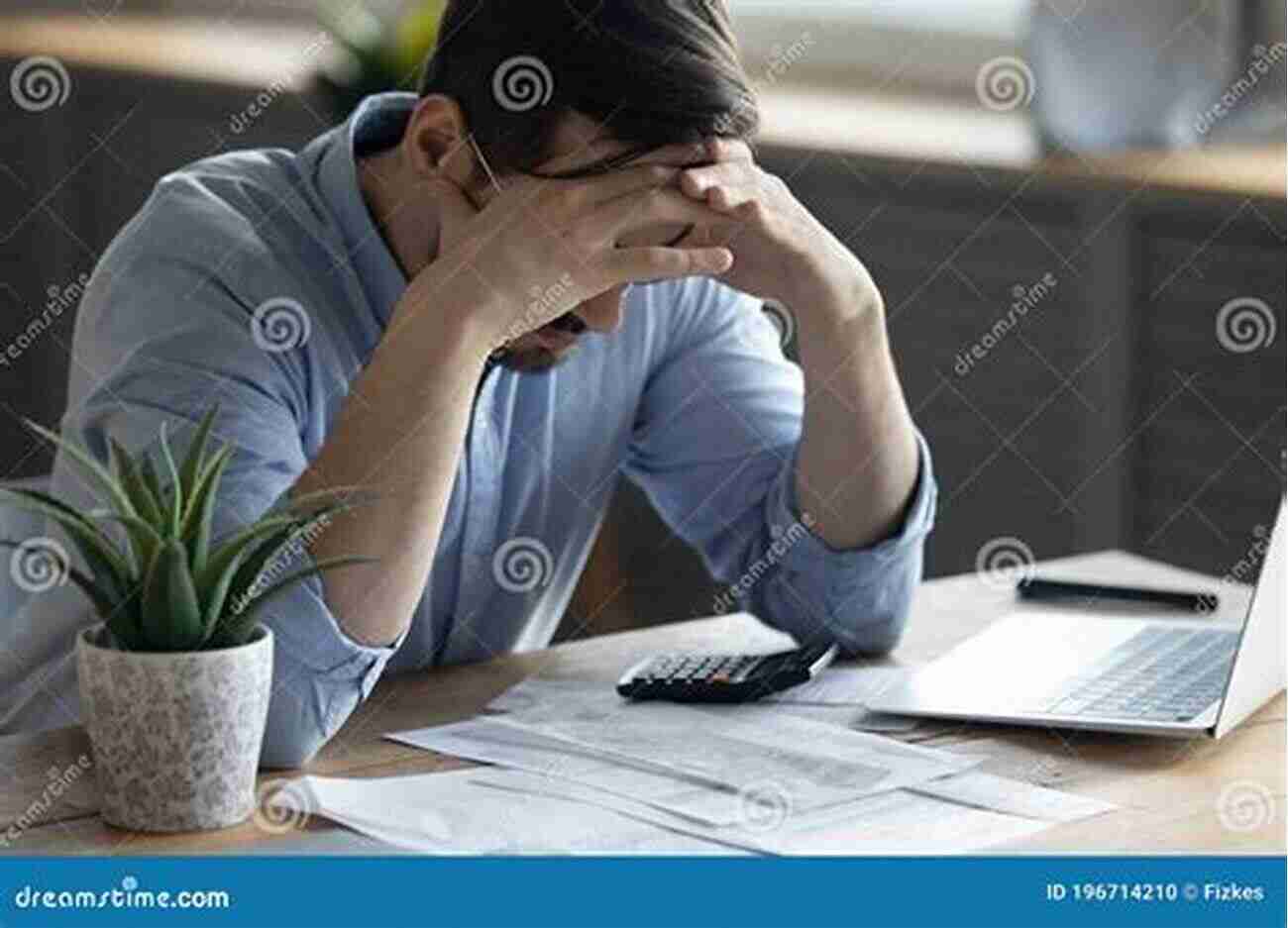

Personal insolvency is a significant issue that affects individuals and economies around the world. When individuals face overwhelming financial debts and are unable to meet their obligations, personal insolvency laws aim to provide a legal framework to enable them to regain control of their financial situation and eventually become debt-free. The regulation and policy surrounding personal insolvency are crucial to create a fair and effective system for both debtors and creditors.

The Importance of Personal Insolvency Regulation

In any given economy, personal insolvency regulation plays a key role in maintaining stability and ensuring that creditors are treated fairly. Regulations typically vary across jurisdictions, but they generally share common objectives. These objectives include providing individuals with relief from excessive debts, preventing abuse of the system, and maintaining confidence in the financial markets.

The principles behind personal insolvency regulation center around balancing the interests of both the debtor and the creditor. It is essential to establish a framework that allows debtors to regain control of their finances while giving creditors a fair opportunity to recover their losses.

5 out of 5

| Language | : | English |

| File size | : | 1247 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 206 pages |

One aspect of personal insolvency regulation is the establishment of bankruptcy laws. Bankruptcy provides a legal process that allows an insolvent individual to either liquidate their assets to repay their debts or create a manageable repayment plan. These laws determine the conditions under which an individual can declare bankruptcy, the validity of creditor claims, and the distribution of assets.

Policy Considerations in Personal Insolvency Laws

When developing personal insolvency laws, policymakers need to consider various factors to ensure the effectiveness and fairness of the system. Some key policy considerations include:

- Debt discharge: Determining the circumstances under which a debtor should be discharged from their debts is crucial. Policymakers need to strike a balance to prevent abuse of the system while providing genuine debt relief.

- Protection of essential assets: Policy frameworks should protect certain essential assets, such as a debtor's primary residence or tools of trade, from being seized to satisfy creditors' claims. This allows individuals to maintain a basic standard of living and encourages economic recovery.

- Debtor education: Promoting financial literacy and providing education on debt management can be an integral part of personal insolvency policy. Empowering debtors with knowledge and resources can help prevent future financial difficulties and improve their chances of successfully managing their finances.

- Alternative dispute resolution: Encouraging mediation and negotiation between debtors and creditors can provide a more efficient and less adversarial approach to resolving debt issues. Effective dispute resolution mechanisms can lead to better outcomes for all parties involved.

Markets And The Law: The Impact on Personal Insolvency

The relationship between markets and personal insolvency is a complex one. Economic factors, such as unemployment rates, interest rates, and housing market fluctuations, can significantly impact personal insolvency rates. In turn, personal insolvency rates can affect consumer spending, investment, and overall economic stability.

Understanding the dynamics between markets and personal insolvency is crucial for policymakers when shaping effective regulations and policies. By analyzing market trends and considering their influence on insolvency rates, policymakers can better anticipate challenges and implement preventive measures to mitigate the negative impacts.

The Future of Personal Insolvency Law

The evolution of personal insolvency law is an ongoing process influenced by changes in the economic, social, and technological landscapes.

Advancements in technology, for example, have led to the emergence of new challenges and opportunities in personal insolvency. Cybersecurity concerns, digital transactions, and the use of cryptocurrencies pose unique challenges for policymakers in regulating insolvency in the digital age.

Moreover, societal shifts and economic crises can lead to changes in personal insolvency rates and increase demands for policy modifications. Policymakers must continuously monitor and assess the effectiveness of existing regulations to address gaps and ensure that the personal insolvency system remains fair, efficient, and responsive to changing needs.

Personal insolvency law regulation and policy play a vital role in providing a framework that enables individuals in financial distress to regain control of their lives. By striking a balance between debtor relief and creditor rights, personal insolvency laws aim to promote economic stability and protect the interests of all parties involved.

The evolution of personal insolvency laws should be an ongoing process, continuously adapting to changes in the economy, society, and technology. Policymakers must remain vigilant and proactive in addressing emerging challenges to ensure that the system remains effective and fair.

5 out of 5

| Language | : | English |

| File size | : | 1247 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 206 pages |

As the radical reforms contained in the Enterprise Act 2002 have come fully on-stream, Personal Insolvency Law has become a major focus of attention. At the same time, all evidence points to increasing levels of personal debt with the consequential rise in bankruptcies. Personal Insolvency Law, Regulation and Policy therefore provides a timely evaluation of the current state of English law in this important area. The volume presents a critical analysis of the regimes of bankruptcy and individual voluntary arrangement in the context of current policy goals. It examines the impact of the Insolvency Act 2000 and the Enterprise Act 2002, and discusses the treatment of bankruptcy within the global economy. The book will be a valuable guide for students and academics engaged in the study of this increasingly important branch of private law. The study will also be of value to practitioners and policy makers.

Harrison Blair

Harrison BlairSoldiers League: The Story of Army Rugby League

The Origin and History The Soldiers...

Bob Cooper

Bob CooperFilm Quiz Francesco - Test Your Movie Knowledge!

Are you a true movie buff? Do you...

Hugh Reed

Hugh ReedDriving Consumer Engagement In Social Media

: Social media has...

Richard Simmons

Richard SimmonsAll You Need To Know About The Pacific Ocean Ocean For...

The Pacific Ocean is the largest ocean in...

Carson Blair

Carson BlairUnveiling the Intriguing World of Complex Wave Dynamics...

The study of complex wave...

Connor Mitchell

Connor MitchellUnraveling the Mysterious Journey of "The Nurse And The...

Once upon a time, in a world of endless...

Colt Simmons

Colt SimmonsHow To Change Your Child's Attitude and Behavior in Days

Parenting can be both challenging and...

Reginald Cox

Reginald Cox10 Groundbreaking Contributions Through Science And...

Science and technology have always...

Ernesto Sabato

Ernesto SabatoUnleashing the Power of Hamilton Education Guides Manual...

Are you struggling with understanding...

Virginia Woolf

Virginia WoolfThe Astonishing Tale of Mars: Lord of the Dragon Throne -...

There has always been a remarkable...

Colt Simmons

Colt SimmonsAn Introduction For Scientists And Engineers Second...

Are you a budding scientist or engineer...

Howard Blair

Howard BlairDiscover the Coolest and Trendiest Friendship Bracelets -...

Friendship bracelets have...

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Deion SimmonsDiscover the Ultimate Guide to Homemade Soap Recipes for Radiant, Healthy...

Deion SimmonsDiscover the Ultimate Guide to Homemade Soap Recipes for Radiant, Healthy... Jim CoxFollow ·2.4k

Jim CoxFollow ·2.4k Cade SimmonsFollow ·12.2k

Cade SimmonsFollow ·12.2k Jason ReedFollow ·9.6k

Jason ReedFollow ·9.6k Yukio MishimaFollow ·3.7k

Yukio MishimaFollow ·3.7k Cristian CoxFollow ·16.2k

Cristian CoxFollow ·16.2k Devin RossFollow ·13.6k

Devin RossFollow ·13.6k Boris PasternakFollow ·5.4k

Boris PasternakFollow ·5.4k Cormac McCarthyFollow ·10.8k

Cormac McCarthyFollow ·10.8k